Broker CRD Numbers

Broker CRD numbers allow investors to look up their brokers using a database called BrokerCheck, which is maintained by the Financial Industry Regulatory Authority (FINRA). “CRD” stands for “Central Registration Depository.” FINRA requires every registered broker who buys and sells securities to have a CRD number. The same is true for registered financial advisors – many financial professionals are dually registered as both brokers and financial advisors.

FINRA BrokerCheck provides information regarding broker licenses, qualifying exams, civil judgments, and disciplinary histories for brokers, as well as essential background information on brokerage firms. Investors should look up their broker’s CRD number to ensure they are properly registered. They will also want to review any potential allegations of misconduct. Ideally, investors should look up the broker’s FINRA CRD number before signing a contract with a brokerage firm.

How Do I Search for a Broker Using their CRD Number?

Go to BrokerCheck.org and look up a broker by their name. Users can also include the brokerage firm name as well as the city, state, or zip code – adding more information may be helpful in case there is more than one broker with the same name.

Why Do I Need to Look Up the Broker CRD Number?

BrokerCheck contains essential information about each broker.

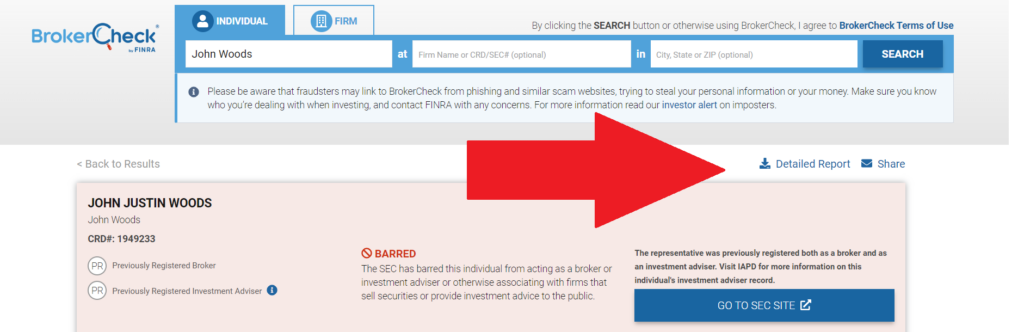

- Looking up a CRD number can help investors avoid fraudsters. Brokers who are not registered with FINRA or who have been barred should not be trusted with hard-earned money.

- It may surprise some investors to learn that firms will hire brokers with significant histories of misconduct allegations. In fact, certain firms have especially high concentrations of brokers with disciplinary records. FINRA may label these institutions “restricted firms.”

- Investors should carefully consider any disclosures before moving forward with a professional relationship, especially if they plan to rely on their broker for investment recommendations. If left unchecked, certain brokers will abuse their position of trust to generate commissions for themselves, to the great financial detriment of their customers.

What Kind of Information Will I Find on BrokerCheck?

FINRA BrokerCheck provides information related to broker employment, experience, education, criminal history, civil liens, regulatory actions, and investor disputes.

Employment disclosures: These records will tell you if the broker has been fired or if they have resigned from their brokerage firm. Firms that have terminated brokers will include allegations that explain their decision.

Regulatory actions: Regulatory bodies like the SEC and FINRA may fine, suspend, or bar a broker following allegations of misconduct. Regulators have rules in place designed to ensure compliance with securities laws. The SEC and FINRA conduct their own investigations, which may run parallel to a criminal investigation. Investigations are sometimes prompted by a broker’s termination from a firm.

- If a broker refuses to provide information requested during the course of a FINRA investigation, they will be barred.

- Brokers may sign “Acceptance, Waiver and Consent” agreements (AWCs) in which they neither admit nor deny the findings, but consent to the entry of findings on their BrokerCheck record as well as any penalties the regulator might impose. The AWC will provide a complete description of the regulator’s allegations, as well as information on which FINRA rules the broker allegedly violated.

Criminal charges: Any criminal charges will appear on the FINRA BrokerCheck record. Investors may want to reconsider a working relationship if their broker has a criminal record that includes any type of fraud, theft, or forgery. Unfortunately, this type of criminal record does not necessarily preclude someone from working in the securities industry.

Investor disputes: If an investor believes they lost money due to broker misconduct, they may file a statement of claim to inform FINRA and the brokerage firm of the nature of the dispute and the amount they are seeking to recover. These disputes appear on FINRA BrokerCheck. If the dispute has been settled via FINRA arbitration, the disclosure will include the settlement amount. Investor disputes that have not yet been settled will be labeled “Pending.” The disclosure will describe the broker’s alleged misconduct.

In some cases, brokers will leave a response to the investor allegations under the “Broker Comment” section.

Outside businesses: The broker’s detailed FINRA BrokerCheck report will list any outside businesses the broker has disclosed to their firm. These disclosures are important in case a broker solicits an investor for an investment outside of the firm. This could indicate a type of broker fraud called selling away.

Civil judgments and financial disclosures: Tax liens, civil liens, and bankruptcies appear on FINRA BrokerCheck records. Investors may not want to work with a broker who does not have their finances in order.

Exams: Each broker profile lists the qualifying exams the broker has passed. This can give you an idea of their specialties. For instance, if a broker recommends an options trading strategy, you can expect to see “Series 9 General Securities Sales Supervisor – Options Module Examination” and “Series 10 General Securities Sales Supervisor General Module Examination” listed on their profile.

Employment history: In order to conduct business, a broker must register with a brokerage firm. But the list of brokerage firms may not offer a complete picture, since brokers may work with a firm that markets its services under a different name. Ask clarifying questions if the firm names on FINRA BrokerCheck do not match the information provided by a broker.

Brokerage Firms on FINRA BrokerCheck

Brokerage firms are required to provide a Customer Relationship Summary (Form CRS). You can also access it via the firm’s FINRA BrokerCheck record. The Customer Relationship Summary includes disclosures concerning the brokerage firm’s conflicts of interest and whether any of their registered representatives have disciplinary histories.

FINRA CRD Numbers: An Imperfect System

A CRD number lookup does not always disclose all the information an investor might want to know about a broker. Furthermore, the FINRA BrokerCheck experience is not very user-friendly, especially for anyone with limited experience in the securities industry.

- Brokers can request disclosures be expunged from their records, and FINRA regularly honors these requests.

- Disclosures may also state that a dispute has been “denied,” but investors should know that firms deny disputes, rather than FINRA or another regulatory body. Denials may simply indicate that the brokerage firm is choosing to side with their broker.

- Unless investors are familiar with FINRA rules, the allegations may not provide a clear picture of the broker’s alleged misconduct.

- Investors should also check and make sure the information provided by their broker matches the information on FINRA BrokerCheck – fraudsters may steal an authentic broker’s information and pass it off as their own.

How to Get a CRD Number

You can find out a broker’s CRD number by simply asking them to provide it – they should have it readily available. If you visit BrokerCheck.org, you can look up a broker by their name. Alternatively, you can call (800) 289-999 to speak with a BrokerCheck representative and request a copy of a broker or a brokerage firm’s report.

Brokers looking to obtain CRD numbers will receive them as soon as they register with FINRA.

Concerns About Broker Misconduct?

If you have concerns about potential broker misconduct, you may need to speak with a securities attorney. The securities industry is rife with investment fraud, and inexperienced investors are especially vulnerable. Overly risky products, commission abuse, and unauthorized trading are common culprits. Speaking with one of our securities attorneys can help you determine if you have a case. Call (877) 600-0098 or email info@kurtalawfirm.com.